ATTAINING OPTIMAL OUTCOMES AND CREATING SUCCESS: A ON PURCHASING MULTIFAMILY FEATURE

Write-Up Author-Noonan Butcher

Are you conscious that multifamily investing can be a powerful device for making best use of returns and constructing wealth? If you’re looking to diversify your investment portfolio and create easy earnings, understanding the ins and outs of this strategy is critical.

Yet where do you start? In this best overview, we will check out the basics of multifamily investing, uncover market patterns and opportunities, and expose methods that will aid you unlock the complete potential of your investments.

Prepare yourself to find the keys to success in multifamily investing and take your financial trip to brand-new elevations.

Comprehending Multifamily Investing Essentials

To understand multifamily investing fundamentals, you need to familiarize yourself with the essential principles and approaches that will certainly aid you make best use of returns and construct wealth.

Primarily, you ought to comprehend the concept of cash flow. In multifamily investing, capital is the amount of cash that can be found in from rental revenue minus the costs. This is a vital statistics as it establishes the profitability of your financial investment.

Secondly, you must consider the area of the building. Buying a desirable location with strong demand for rental units will certainly enhance your possibilities of bring in tenants and taking full advantage of rental earnings.

Furthermore, it is necessary to assess the capacity for admiration. Look for homes in locations with forecasted growth and advancement as this can lead to an increase in property value over time.

Lastly, ensure to carry out complete due diligence when examining potential financial investments. Examine the financials, evaluate the residential or commercial property, and evaluate the market problems prior to choosing.

Studying Market Trends and Opportunities

Now that you have a strong understanding of the basics of multifamily investing, it’s time to explore just how evaluating market trends and opportunities can better improve your financial investment method.

By remaining on top of market fads, you can identify arising chances and make informed choices that will certainly optimize your returns and develop wide range.

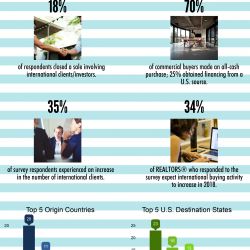

One crucial facet of evaluating market trends is researching supply and need characteristics. Recognizing the demand for multifamily housing in your target audience will certainly help you identify areas with high rental demand and capacity for rental fee development.

Additionally, analyzing economic signs such as task growth, population growth, and rental vacancy rates can supply important insights into market conditions.

Implementing Strategies for Taking Full Advantage Of Returns

Maximize your returns and construct wealth in multifamily investing by applying reliable methods. Here are three vital approaches to help you attain your goals:

1. Optimize rental income: Raise your cash flow by setting competitive rental rates, minimizing vacancy durations, and applying routine rent testimonials. Take into consideration adding value with residential or commercial property upgrades or facilities to attract higher-paying occupants.

2. Effective building monitoring: Streamline procedures by outsourcing tasks such as upkeep and renter testing to specialist residential or commercial property management business. This permits you to focus on the larger photo and maximizes your time to recognize brand-new investment chances.

3. Take advantage of financing choices: Benefit from low-interest rates and numerous funding options readily available to multifamily investors. https://squareblogs.net/omer7zachery/enhancing-your-profile-techniques-for-attaining-multifamily-financial as government-backed financings, partnerships, or submission to optimize your purchasing power and reduce your capital expense.

Conclusion

So there you have it, folks! The ultimate overview to multifamily investing, where you can amazingly transform a small financial investment into a mountain of wide range.

Simply follow commercial property purchase costs and see your returns escalate. That requires a clairvoyance when you can examine market trends like a pro?

And forget persistence and careful preparation, simply carry out some approaches and voila! Immediate success. It resembles a get-rich-quick scheme, but entirely legitimate.

Delighted investing, and might the wealth be with you!